The forecast for 2019 global cereal production lowered while stocks raised – FAO

FAO lowered its forecast for global cereal production in 2019 by 2.2 million tonnes, pegging the world cereal output at 2 706 million tonnes, but still up 53 million tonnes (2.0 percent) from the outturn in 2018. The latest cut emanates mostly from reduced prospects for global rice and wheat outputs, which outweighed a bigger production forecast for coarse grains. Global wheat production is pegged at 766 million tonnes, down nearly 1 million tonnes from last month’s forecast, though still a record high. The reduction reflects a cut to Australia’s production forecast on account of continued dryness in eastern regions. This decline more than offset an upward revision to the production estimate for the European Union, where recent field data indicate better than previously anticipated yields.

The latest forecast for global rice production (milled equivalent) is set at 513.5 million tonnes, down 3.8 million tonnes from the previous report and just 0.8 percent below the high output level registered in 2018. India accounts for the bulk of the month-on-month downward revision, as a series of weather setbacks caused planting delays leading to expectations that farmers would plant less than previously anticipated. Production prospects also deteriorated in the United States, where excess rains are now estimated to have triggered more pronounced area cuts than earlier envisaged. Similarly, in the Philippines and China, recent reports indicate a lower area planted in 2019, resulting in a small downgrade of the production forecasts for these countries. By contrast, production outlooks improved in Colombia and Madagascar, where crops have already been harvested and official estimates indicate better than previously anticipated yields.

World coarse grains production is forecast at 1 427 million tonnes in 2019, up 2.5 million tonnes from the previous report issued in September. The more buoyant expectations mostly rest on an improved outlook for global barley production, while the overall positive prospects for the world maize output were further reinforced following a lifting of the production estimate for Brazil, where the major second season harvest is nearing completion. Additionally, the forecast for maize production in the United States has been raised on larger-than-expected plantings; however, an equivalent cut in the forecast for the European Union’s production negated any impact on the global outlook.

Looking further ahead, planting of the 2020 wheat crop in the Northern Hemisphere is already underway. In the Russian Federation, early indications point to an area expansion, which would support the short-term trend underpinned by government policies that seek to boost exports, while by contrast dry weather conditions have curtailed planting expectations in Ukraine. For coarse grains, the 2020 crops are being planted in southern hemisphere countries, with harvesting expected to commence in the first quarter of next year. In Brazil, following a record output in 2019, plantings of the first season crops are progressing under mostly favourable weather conditions and an increase in the minimum producer price for maize, set by the government, could prompt an area expansion. In South Africa, higher year-on-year prices and tighter domestic supplies could instigate an increase in the sown area and result in a production rebound in 2020.

World cereal utilization in 2019/20 is now forecast at 2 714 million tonnes, down 1.7 million tonnes from September, but still 34 million tonnes (1.3 percent) higher than in 2018/19 and marking a record high. The forecast for total wheat utilization has been raised by 1.5 million tonnes since the previous report to 761.5 million tonnes, which is also a record exceeding by 2.0 percent the 2018/19 estimated level. At nearly 518 million tonnes, food consumption accounts for most of the total utilization of wheat. However, driven by large supplies and attractive prices, the projected increase in world wheat utilization in 2019/20 is also boosted by an expected 3.6-percent rise in its feed use, which could reach an all-time high of 146 million tonnes. Total utilization of coarse grains in 2019/20 is forecast at 1 436 million tonnes, down marginally from the September report but still a record high, up 1.0 percent (14 million tonnes) from 2018/19. While the bulk of the year-on-year increase in total utilization of coarse grains is due to stronger demand for maize, especially for industrial use, the forecast for maize feed use in 2019/20 has been trimmed by around 5 million tonnes since the previous report, to just over 648 million tonnes. The revision largely stems from downward adjustments to feed use estimates in China and the EU. FAO’s new forecast for world rice utilization in 2019/20 is pegged at 516 million tonnes, down 2.3 million tonnes from September due to less buoyant domestic use prospects for Asia. Nonetheless, at this level, global utilization of rice would still exceed the 2018/19 record high by 1.1 percent, driven by expanding food intake.

The forecast for world cereal stocks by the close of the 2020 seasons has been raised by 2.4 million tonnes since the previous month to 850 million tonnes, but still down 17 million tonnes (2.0 percent) from their opening levels. This month’s higher forecast for ending stocks, combined with a lower forecast for utilization, results in a slightly higher stocks-to-use ratio for total cereals in 2019/20, now projected at 30.4 percent, still down slightly from 31.9 percent in 2018/19. Among the major cereals, global wheat inventories are anticipated to register a 1.6 percent (4.2 million tonnes) increase from their record high opening level to total 273 million tonnes – the second highest on record. The increase is expected to be concentrated in Asia, in particular in China and, to a lesser extent, India, more than offsetting anticipated declines in several major exporting countries. By contrast, despite this month’s higher forecast of ending stocks in the United States, world maize inventories are still foreseen to register a significant decline in 2019/20, falling by as much as 7 percent (25 million tonnes) from their relatively high opening levels to a 4-year low of 337 million tonnes. This is mostly because of a predicted sharp drop in maize stocks in China, making up almost 70 percent of the year-on-year projected decrease. Global rice stocks at the close of 2019/20 are pegged at 179 million tonnes, up 800 000 tonnes from previous expectations, but still 1.9 percent below the 2018/19 all-time high of 183 million tonnes. This month’s adjustments mostly stem from upward revisions to carry-overs in India, where record-breaking local procurement during the 2018/19 season is likely to result in larger than previously anticipated public inventories. These increases outweighed reductions to stock forecasts mainly for China and the United States.

FAO’s latest forecast for world trade in cereals in 2019/20 remains at around 415 million tonnes, unchanged from last month and 0.7 percent (almost 3 million tonnes) above the 2018/19 level, with expectations of higher wheat, rice and barley trade just marginally offsetting lower maize and sorghum trade. World wheat exports in 2019/20 (July/June) are set to rebound by 3.4 percent (5.7 million tonnes) to reach 173.5 million tonnes, mostly because of stronger import demand in Morocco and Asian countries. To meet this increase, several countries are forecast to raise their sales in 2019/20, in particular Argentina, the EU and Ukraine. On the other hand, shipments from Kazakhstan and the Russian Federation will most likely decrease, largely because of tighter domestic supplies than in the previous year, although the Russian Federation would remain the world’s largest wheat exporter also in 2019/20. Following an 800 000 tonne downward revision since September, world rice trade in 2020 (January-December) is now forecast to amount to 48 million tonnes, up 3.5 percent from the 2019 level, with much of the expected recovery imputable to strong African import demand. For coarse grains, however, even with this month’s small upward revision, trade in 2019/20 (July/June) is foreseen heading to an annual decline of 2.2 percent (4.4 million tonnes), with expected lower maize imports by the EU, China and Canada accounting for most of the decline. Total maize trade in 2019/20 is pegged at around 161 million tonnes; while down by over 4 million tonnes from the peak registered in 2018/19, it would still be the second highest on record. From the maize exporters’ perspective, shipments from the United States and Ukraine are foreseen to fall sharply, while sales from Argentina and Brazil could attain near-record, if not record, levels.

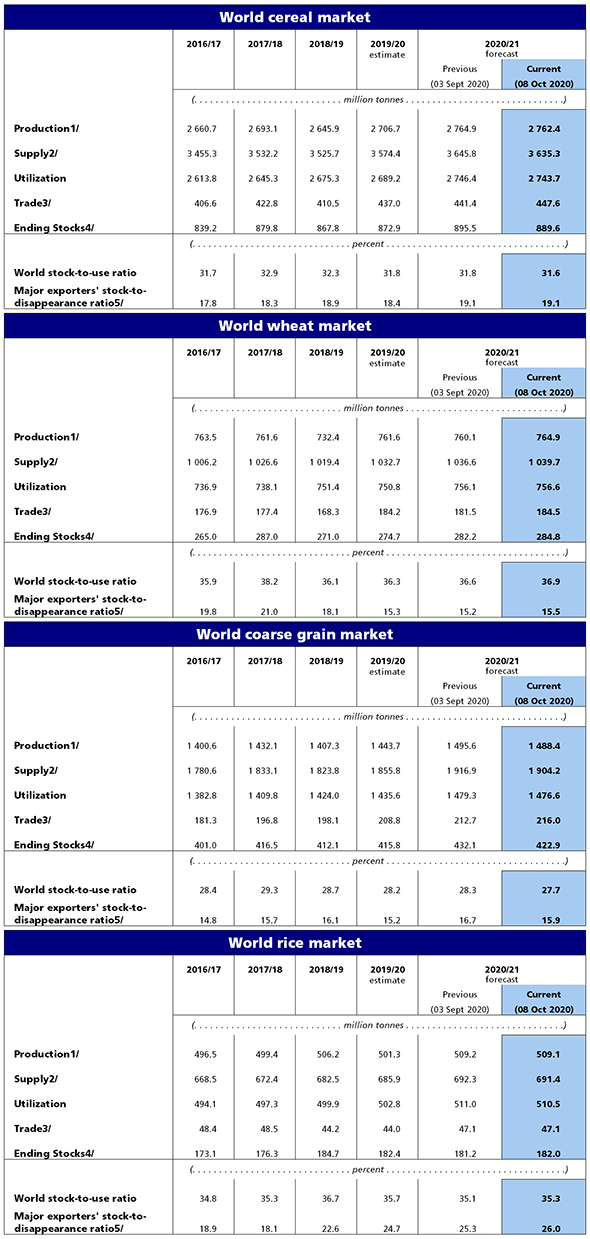

Summary Tables

|

|

Read also

Growing demand for corn in Vietnam points to increased imports

BLACK SEA GRAIN. KYIV conference brought together grain market participants and ex...

Argentina bug invasion knocks $1.3 billion off corn crop

Growth of corn prices in Ukraine limits the fall in world prices

Argentine farmers call for ‘urgent’ end to wheat export taxes

Write to us

Our manager will contact you soon