USDA forecasts intense competition on wheat, corn

ABUNDANT exporter supplies are expected to create increased competition for market share in the 2020-21 global market, despite projected record global demand, according to the May USDA World Agricultural Supply and Demand Estimates (WASDE) report released overnight.

The report contains USDA’s first look at 2020-21 (July-June) global wheat production, and says Argentina is again expected to have large exports based on expanded area.

It forecasts Australia to have its largest crop in four years, and reduced domestic feedgrain demand caused by improved pasture conditions.

“As a result, Australia is likely to regain its place as leading supplier to South-east Asia,” the report said.

Canada is projected to have larger production and another year of strong exports which will provide direct competition with US wheat in key Latin American and Asian markets in contrast to 2019-20, when exports were periodically constrained by logistics bottlenecks.

Conversely, exports from the European Union are forecast to plunge as a result of a much smaller crop, and reduced wheat availability and large global corn supplies will lead to a decline in the use of wheat for animal feed.

“Tighter EU exports are likely to benefit Russia the most of all the major exporters.”

Wheat export outlook

After a year of lower-than-anticipated export levels, Russia will regain its place as the world’s leading wheat exporter with another bumper crop.

Russia is forecast to produce 77Mt of wheat in 2020-21, up 5pc from 2019-20, and includes 57Mt of winter wheat and 20Mt of spring wheat.

Its exports will likely be competitively priced and move rapidly in the first half of its marketing year, potentially limiting competitor shares from July to December.

In addition to this year’s near-record crop, India maintains an immense amount of domestically grown wheat stocks, accumulated over many years due to its steadily increasing minimum support price (MSP).

“Indian wheat exports are seen as limited due to uncompetitive prices, but are expected to increase to neighbouring countries.”

Demand for Kazakhstan’s wheat in neighbouring countries has been growing and exports are likely to rise depending on COVID-19 related quotas put in place until September to ensure domestic food security.

With improved weather, Kazakhstan wheat production is forecast higher on increased yields, despite reduced planted area.

Smaller production, lower global corn prices, and COVID-19-related export restrictions are likely to limit Ukraine’s wheat exports.

A fair portion of Ukrainian wheat is used for feed which can be substituted for corn and barley feed, depending on price.

US wheat exports are projected lower as increased competitor supplies will reduce demand for US wheat in price-sensitive markets.

Export prospects to China have improved since the Phase One Agreement entered into force as several 2020-21 sales were made earlier this year.

COVID impact

COVID-19’s impact on wheat demand has varied according to each country’s culture, economic development, and consumption patterns, and the report said these impacts have been taken into consideration in its global wheat projections.

“At the micro level, the pandemic has created a consumption shift, with reduced commercial demand in restaurants and hotels as a result of social-distancing practices and limited travel.

“On the other hand, retail demand has increased with a shift from dining out to home-prepared meals.

“Globally, some producing countries are showing stronger demand for wheat products as consumers revert to bread and pasta as key staples.

“Alternatively, demand in other importing countries is negatively impacted by economic slowdowns resulting from reduced tourism or a shift to other staples such as rice.”

COVID has affected trade, with some producing countries, concerned with domestic food security, imposing temporary export restrictions on staples.

“While trends have varied by country, USDA data currently shows that the COVID-19 impact on overall global consumption of wheat for food use has been minimal to date.”

Wheat prices react

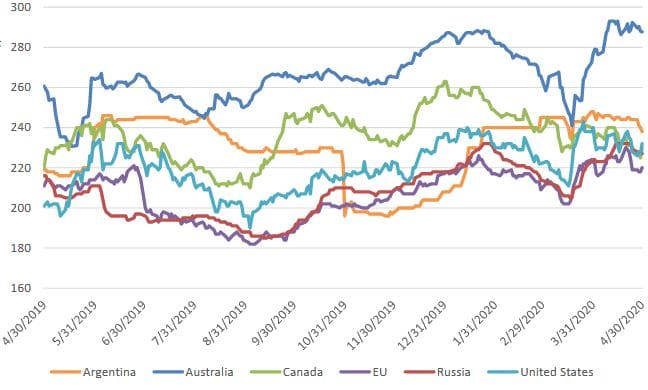

Global exporter prices showed mixed directions during April.

Russia’s wheat prices rose slightly as export restrictions continue as a result of COVID, while EU prices fell to make them more competitive with Russia.

US wheat prices also declined, pressured by expectations for large competitor crops, and Canada’s prices dropped even further on expectations for a large crop and easing transportation logistics.

Canada’s (CWRS) prices are currently at a rare discount to US HRW.

Australian prices rose to a one-year high during April as supplies tighten seasonally, and Argentina’s prices were pressured by a weakening currency and generally good planting conditions for its 2020-21 crop.

Australian wheat export bids (top blue line) climbed more steeply than all other exporters (US$/t fob) Source: IGC in USDA Grain: World Markets and Trade

Corn up

Global corn production in 2020-21 is projected to rise, primarily driven by a recovery in US area.

Major exporters the US, Brazil and Ukraine are all projected to have record crops, while Argentina has another near-record crop.

Global production is forecast to exceed consumption for the first time in four years, and feed and non-feed use are expected to grow under exceptionally low prices, spurring expansion in global trade.

Ending stocks are projected to rise as the US is set to have its highest ending stocks since 1987-88, offsetting a decline in China.

European wheat conditions mixed

Planting occurred during in drier-than-average weather in autumn, while early spring conditions, especially in the southern and north Caucasus districts, have been drier-than-average as well.

These have since had timely rain.

Accelerated spring growth has stalled with a pattern of cooler temperatures that has slowed crop development.

Potential winter-wheat yields will hinge largely on weather during this and next month.

Planting of spring wheat began in late April and is on track with the previous year at about 12 pc complete as 30 April.

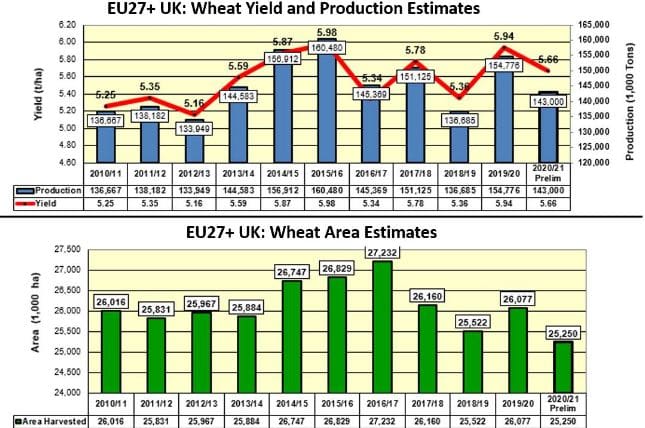

Europe’s harvested wheat area is estimated to be its lowest since 2007-08 due to challenging planting conditions in autumn in north-western Europe including the UK, which is looking at its lowest wheat area since 1978-79.

France, the largest wheat-producer in Europe, is looking at its smallest wheat area since 2001-02.

A dry autumn in south-eastern Europe affected planting, while soil-moisture conditions in Spain since November have been exceptional, bolstering record production expectations.

Winter throughout Europe was very mild, and current yield concerns centre around dryness in central Europe.

Projected this year lower wheat area, yield and production across EU-bloc plus the United Kingdom (million tonnes). Source: USDA

Production to outpace consumption

For 2020/21, global wheat production is forecast up with larger crops in most major exporting countries.

Production for Argentina, Australia, Canada, Kazakhstan, and Russia is forecast higher than the previous year.

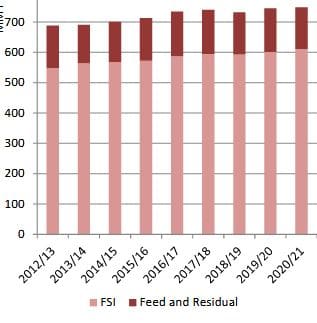

Overall consumption is up with larger Food, Seed, and Industrial (FSI) use more than offsetting reduced feed and residual use.

Food consumption continues to rise due to population growth and changing diets, especially in developing regions of Asia.

Feed use is expected lower this year as wheat prices are expected to be less competitive with corn.

Consumption, production, trade, and stocks are all forecast to reach records, with China still expected to represent more than half of global wheat stocks.

Wheat production summary

Global production is forecast at a record 768 million tonnes (Mt), up more than 4 Mt from last year.

Production among the top eight exporting countries is projected up a combined total of nearly 3Mt.

- Russia’s crop is forecast higher based on expanded area and expectations of improved yields;

- Kazakhstanis expected to have a larger crop with higher yields after last year’s drought;

- Canada’s crop is projected larger based on expanded area;

- Argentina’s crop is forecast to be slightly higher.

- EU production is forecast down by nearly 12Mt on reduced area.

- Production for the US and Ukraine is forecast down slightly.

- China as the world’s second-largest wheat producer is expected to produce 135Mt;

- India as the third-largest producer is down marginally at 103Mt.

- PakistanandBrazil are projected up slightly on higher projected yields.

- Major importers Egypt and Turkey are expected to have production nearly unchanged from 2019/20;

- Algeria, Morocco, and Tunisia are all projected to have smaller crops on reduced yields, while Ethiopia and South Africa are both expected to have larger production.

Record consumption seen

Global wheat consumption is projected at a record, driven by food, seed and industrial (FSI) use. FSI consumption makes up more than three-quarters of wheat use and consistently trends upwards over time with population growth.

Growth is particularly significant in South and East Asia, based on rising food use in India and China. Food consumption in the Middle East and North Africa is also stronger with growth seen across many major markets.

After several years of strong growth, food use in Sub-Saharan Africa and South-east Asia is expected to grow at a slower rate in the coming year with weaker economic growth.

In 2020/21, feed wheat use is expected to decline with higher prices relative to corn.

Wheat feeding in South-east Asia, Canada and the US is projected to decline, largely because of abundant supplies of corn.

Food use of wheat continues to increase. Feed will decline this year (million tonnes). Source: USDA

Wheat stocks, trade head for record

Global wheat stocks are projected to reach another record with China accounting for more than half of the total.

Combined wheat stocks for the top eight global exporters are projected up slightly from 2019-20, an estimated six-year low, with US stocks forecast to represent nearly 40pc of this total.

Global trade is forecast to rise 2pc to a record 187Mt, with stronger demand expected across several regions.

“North Africa leads as the largest importing region and shows the greatest year-to-year growth.

“Consumption continues to rise with larger imports needed because of lower projected production levels in Algeria, Morocco, and Tunisia.”

Egypt is again forecast to be the world’s leading importer and is forecast to match its record 2019-20 imports.

A decline is expected for the Middle East, primarily driven by Turkey.

East Asia is projected to have strong import growth driven by China’s growing population and demand for Western-style baked goods contributing to consumption growth.

However, production continues to exceed consumption, resulting in rising stocks.

Japan, South Korea, and Taiwan continue as steady and consistent consumers.

Sub-Saharan Africa remains a significant importing region as the majority of consumption is met through imports. After a few years of major growth, its imports have leveled off in the last few years.

A decade of exponential import growth has resulted in Indonesia becoming the world’s second-largest wheat importer with a preference for Australian wheat for noodle manufacturing.

The Philippines has also seen long-term import growth as wheat has become an integral feed ingredient.

Read also

Growing demand for corn in Vietnam points to increased imports

BLACK SEA GRAIN. KYIV conference brought together grain market participants and ex...

Argentina bug invasion knocks $1.3 billion off corn crop

Growth of corn prices in Ukraine limits the fall in world prices

Argentine farmers call for ‘urgent’ end to wheat export taxes

Write to us

Our manager will contact you soon